INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Chipmaker NXP Semiconductors NV today reported a slight revenue decline for its second quarter ended July 2, but nonetheless managed to top analyst expectations.

The company also surpassed the consensus estimate across several other key financial metrics. Investors approved of the results, sending NXP’s shares up more than 4% in trading.

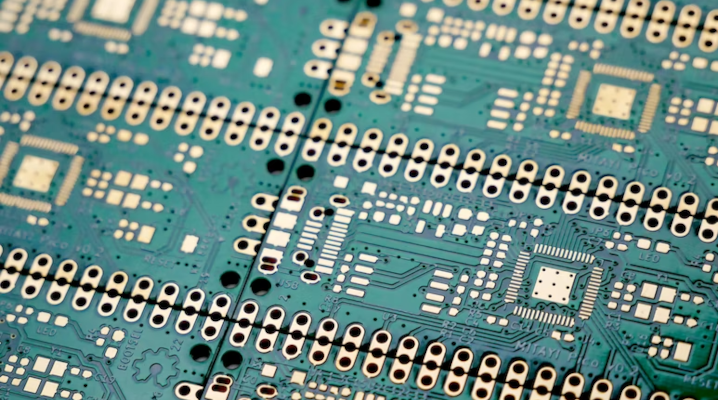

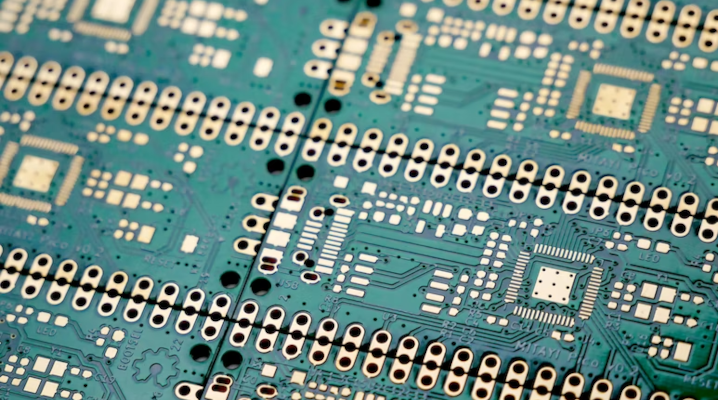

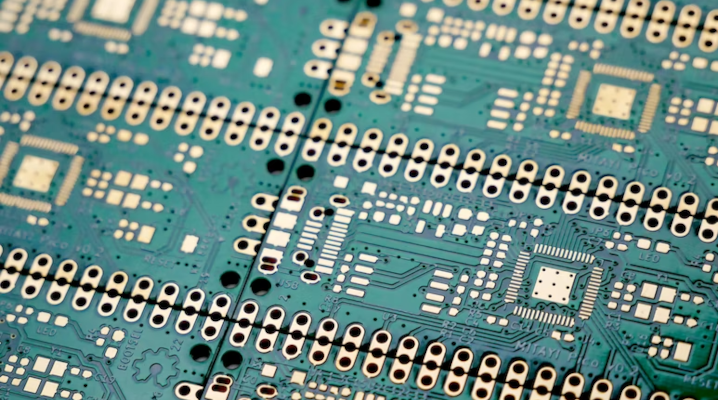

Netherlands-based NXP is a major supplier of chips to the auto sector. Its processors can be found in infotainment units, instrument panels and a variety of other vehicle subsystems. NXP silicon is used for certain other tasks as well, such as distributing over-the-air firmware updates to cars.

The data center market is another area where the company maintains a presence. It sells a line of network chips, the Layerscape series, that hardware makers can use to build routers and switches. The other processors in NXP’s product portfolio focus on use cases as varied as smart home management and robotics.

NXP generated $3.3 billion in revenue during its second quarter, down 0.4% from the same time a year earlier. The sales drop was caused primarily by lower demand for the company’s industrial, internet of things, and mobile chips. In the latter market, it experienced a 27% year-over-year revenue slump.

NXP’s core vehicle chip business, in contrast, managed to grow its top line by 9%. The company also logged increased demand for carrier infrastructure processors. As a result, NXP’s second quarter revenue reportedly topped the consensus analyst estimate by about $90 million despite declining on a year-over-year basis.

The chipmaker surpassed expectations in the profitability department as well. NXP closed the second quarter with adjusted earnings of $3.43 per share, whereas analysts had projected $3.29.

For its current quarter, the chipmaker is projecting revenue of between $3.3 billion and $3.5 billion. The high end of NXP’s guidance significantly exceeds the $3.31 billion projected by the Refinitive consensus estimate. NXP’s adjusted earnings guidance of $3.39 to $3.82 per share, in turn, was likewise higher than what analysts had expected.

“Our first-half results and guidance for the third quarter underpin our confidence that NXP is successfully navigating through the cyclical downturn in our consumer-exposed businesses,” said Chief Executive Officer Kurt Sievers.

NXP’s plan to return to revenue growth emphasizes new product development.

In the second quarter, the company inked a partnership with Taiwan Semiconductor Manufacturing Co. Ltd. to make a new line of MRAM chips for vehicles. MRAM is a type of memory that can store only limited amounts of data, but is more durable and uses less power than DRAM. The technology is used not only in vehicles but also ruggedized systems such as industrial robots.

The past quarter also saw NXP introduce a new line of processors called the i.MX 91 series. It’s designed to power low-cost edge computing devices powered by Linux.

THANK YOU